Growth is skyrocketing in the space sector, with McKinsey estimating it as a $447 billion market in 2023 that will grow to more than $1 trillion by 2030. This same growth can be seen in the number of satellites in orbit, which has grown to 11,000 (a 38% year-on-year growth) and hosts more than 10,000 companies from manufacturing, to launch, to operations and more.

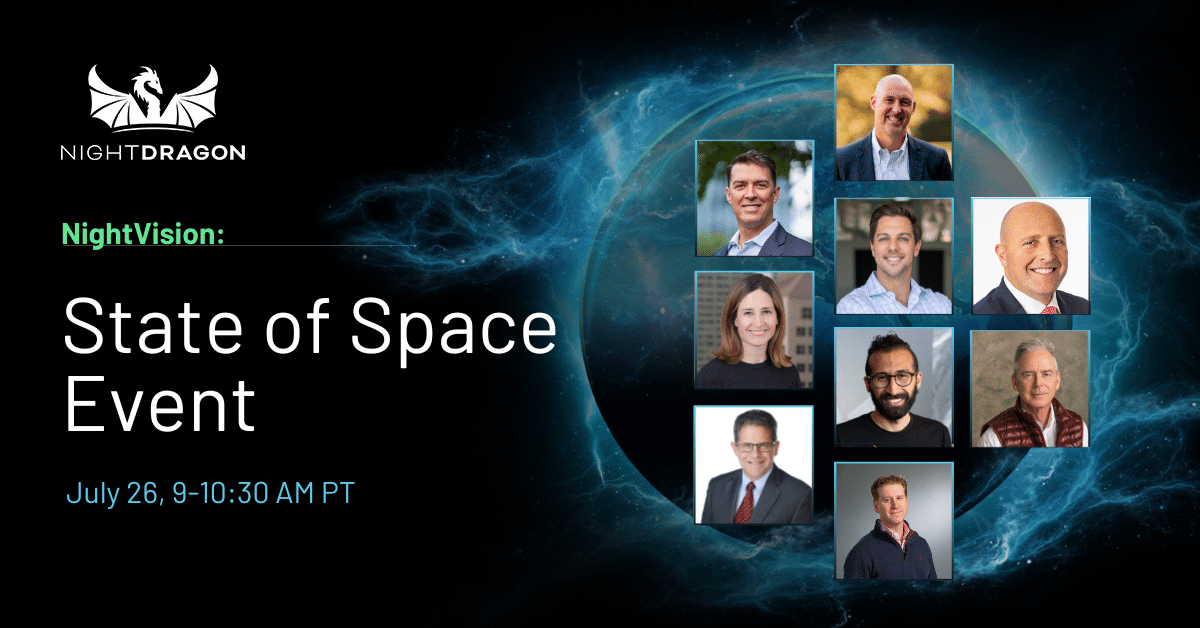

To take a deeper look at the drivers behind this growth, as well as the new innovation and investment opportunity it’s spurring, we hosted our first NightVision State of Space event, where we interviewed top leaders from across this growing economy, including defense contractors, partners, leading startups, investors, and more to provide a 360o view of the state of the market and where it is headed in the future.

Speakers for the event included:

Opening Keynote:

- Doug Wolfe, CTO, Jacobs

- Moderator: Ken Gonzalez, Managing Director, NightDragon

State of the Space Market: VCs and Wall Street analysts discuss the state of the market, what areas are growing, where is there greenfield, what areas are losing investment, etc.

- Moderator: Katherine Gronberg, Head of Government Services, NightDragon

- Ken Gonzalez, Managing Director NightDragon

- Matt O’Connell, Operating Partner, DCVC

- Bryan Chambers, President and Co-Founder, Capital Factory

The Next Frontier of Space Innovation: Innovators discuss leading emerging technology categories and potential within the space sector.

- Moderator: Ken Gonzalez, Managing Director, NightDragon

- Payam Banzadeh, CEO, Capella Space

- John Serafini, CEO, HawkEye 360

- Rob Geckle, Chairman and CEO of Airbus U.S. Space & Defense

- Dave Broadbent, President, Space Business, Raytheon

The complete recording of each panel can be found below. Here are some key takeaways from the industry leaders on where the space industry is headed in 2023 and beyond:

- Lower Cost Launch Causing Inflection Point in Space – Jacobs CTO Doug Wolfe said much lower cost launch capabilities have driven an ability to launch and return satellites more frequently, which has been key to driving a “hockey stick of growth for the entire industry right now” across most or all major categories, including launch, orbit servicing, satellite life extension, sensors, data processing, personal travel and more.

- International Competition Dynamics – Jacobs’ Wolfe said, like many other areas of tech, international competition is on the rise in the space sector. This includes both government agency efforts and commercial companies, he said. He said continuous innovation needs to remain a national priority to ensure leading technology isn’t being developed offshores, unless with partners and allies. “There’s a huge economic advantage, but when you really look at it from a national security perspective, space has given us a huge advantage for a long time,” he said. “That’s not lost on our adversaries. I think they have a lot of interest in replicating, duplicating, perhaps disrupting or even exceeding our capabilities.”

- Commercial Space Sector Continues to Rise – One of the biggest trends that many of the panelists said they were watching is the growing commercial sector in space. “This is one of the first times where space is much more standalone in a commercial standpoint,” Jacobs’ Wolfe said, bringing innovation around communications, high-speed cell services, data services, and other advancements. This dynamic has allowed for even faster innovation, said Airbus’s Rob Geckle, as commercial innovation is not beholden to defense acquisition procurement schedules.

- AI and Analytics – In addition to lower cost of hardware, Raytheon’s Dave Broadbent said he is also seeing a rise in artificial intelligence (AI) and analytics technology proliferation, including at low Earth orbit (LEO) and also more recently at near-Earth orbit (NEO) as well. As the magnitude and volume of data increases, AI and machine learning become increasingly important to managing that data and deriving insights from it to match the speed of the threat or target at hand, he said. That said, HawkEye 360’s Serafini said AI continues to be in “early innings,” with lots of potential for growth to come around generative AI and other areas.

- Innovators Founding Multiple Companies – As the industry continues to advance, Capital Factory’s Bryan Chambers said he is increasingly seeing the trend of founders starting their second or third companies now looking for funding in the space sector. “I think that’s only going to increase the likelihood of success and increase the level of experience and the talent pool,” he said. “I think we’re going to continue to see that and it’s going to fuel a lot of growth.”

- Government Funding Continues – While the commercial sector has grown to new heights, the government also continues to be a major player in driving growth for the space sector, panelists agreed. “It really de-risks and makes way for the private sector to participate with reasonable economics and some mitigated risks,” said Capital Factory’s Chambers, specifically around eliminating some of the early capital barriers that historically have served as barriers to early-stage companies in the sector. DCVC’s O’Connell agreed, saying that a great partnership between government and commercial has emerged, helping drive innovation to new heights.

- Full Ecosystem from Seed to Late-Stage Growth – As the space market continues to mature, that has resulted in a full-scale ecosystem from seed to late-stage in the space and defense sectors, said NightDragon’s Gonzalez. What’s more, there is a path to exit for these companies, either through IPO or acquisition. “The inflows in this market have grown massively over the last few years,” he said.

- Shift Back Towards In-House Integration – While third-party manufacturing used to be a popular choice to build hardware components for satellites, HawkEye 360’s John Serafini said he is seeing a shift back in the industry towards in-house integration. This helps ensure supply chains are more trustworthy and reliable from end-to-end, he said. Additionally, Capella Space’s Banazadeh said bringing the supply chain back in-house helps ensure everything is built to order, even if it may come at a slightly increased cost in some cases.

- Consolidation Coming – The rapid rise in the number of companies, a capital-intensive business model, and other factors will likely drive consolidation in the market in the coming years, panelists agreed.

- Markets to Watch – When asked what markets the ones are to watch, panelists cited communication services, intuitive machines landing on the moon, off-world construction using 3D printing, robotics, space servicing, operationalizing the stratosphere, ultra-long endurance drones, in-space manufacturing, and more.

A full recording of the event can be found above. To view NightDragon’s other NightVision events, visit our Events page.