By Dorin Baniel, Principal and Head of EMEA, NightDragon

2023 was a year of recovery and resilience around the world, poised with new geopolitical challenges. We ended 2022 with central banks worldwide focusing on restoring price stability following lower interest rates that caused a drastic rise in inflation. Couple this with pressures around the Russia-Ukraine conflict, tensions between the USA and China, including concerns around global supply chain disruption following the pandemic. Already in the second half of 2022 and all through 2023, we saw the impact on public markets – fewer IPOs and decrease in value for already-publicly listed organizations. This subsequently led to private market caution, where the power shifted back to investors: Non-traditional investors started backing away from the game they entered in 2021, multiples started normalizing to pre-pandemic levels, and startups were much more focused on efficiency for extended runway and decreased cash burn, rather than fast scale. For Israel, these trends held true as well. Below I double click on the current investment landscape in Israel, including the impact of the Israel-Hamas war on venture, and predictions for what’s to come.

Setting the Stage for Israel Cybersecurity Market

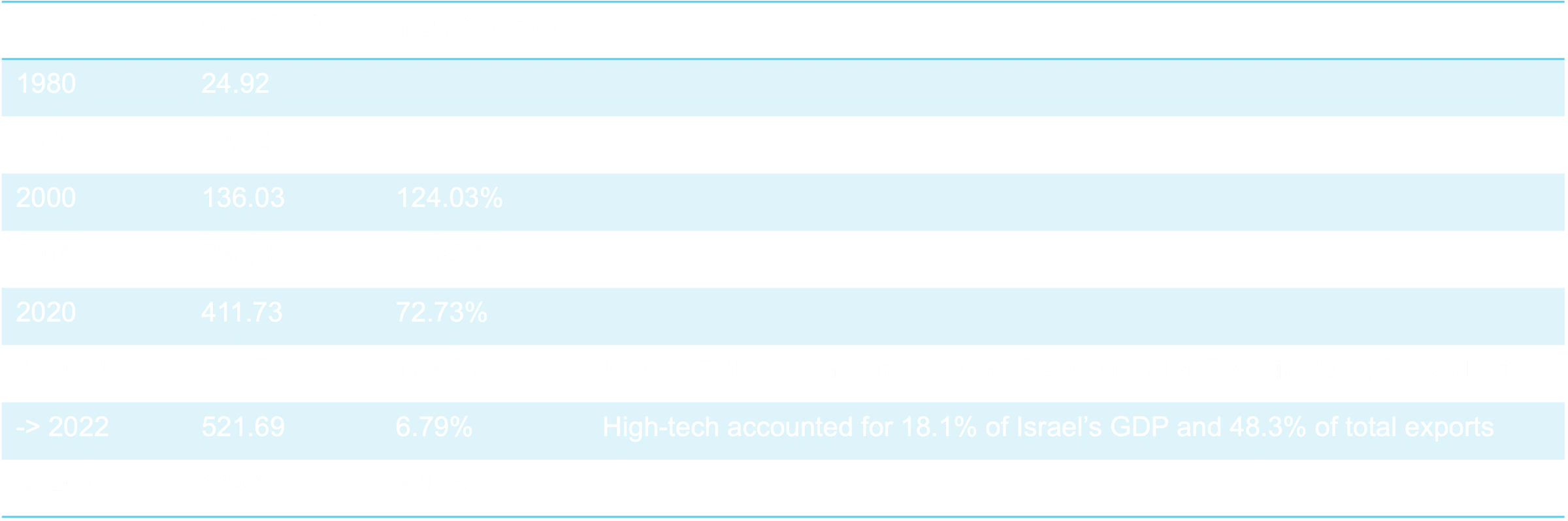

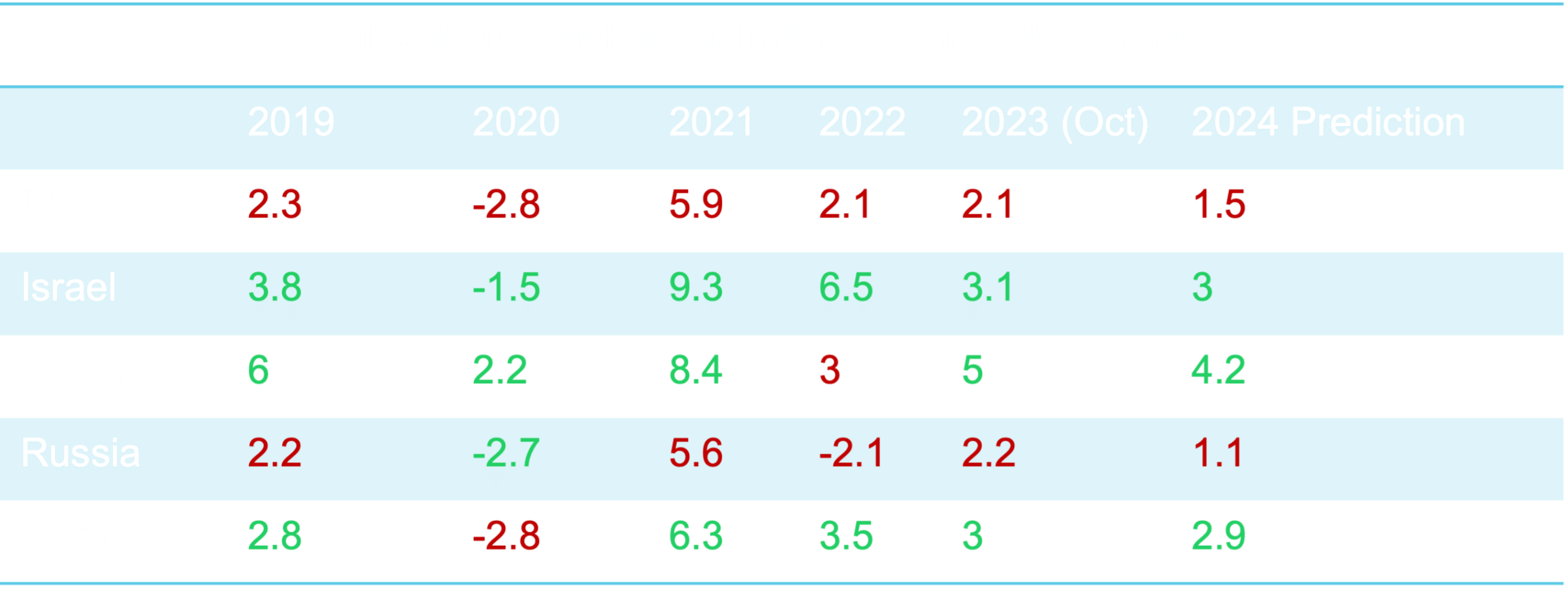

While the global trends of rising inflation, rising interest rates, and a cooling of the housing market have impacted Real GDP, Israel’s 2023 Real GDP of 3.1 remains higher than the world’s average of 3. The country’s nominal GDP stands at $564B with 8.14% YoY growth, with high-tech accounting for 18.1% of Israel’s GDP (the largest sector in terms of economic output) and accounting for nearly 50% of the country’s total exports.

What remains to be seen is the impact to be seen from the current Israel-Hamas war, which began on October 7 of last year. Factors potentially impacting GDP include the high costs of the war and the immediate call for duty of 400K+ reservists (impacting high-tech exports). However, Israel’s GDP growth has continuously outpaced the OECD average, now as well as during both the 2006 Lebanon War and Operation Protective Edge in 2014, indicating economic strength and resilience despite adversity.

Main factors impacting GDP growth in 2023 align with global trends:

- Rising inflation

- Rising interest rates (from 0.1% to 4.75% between April 2022 to May 2023)

- Cooling of the housing market (although it’s still nearly impossible to find a good apartment in Tel Aviv at a reasonable price!)

- TBD: Israel-Hamas, “Iron Swords” War – see below for details

Technology Growth Continues to be Key to Israel Economy

Israel has been known as the land of milk & honey for years, but really it is the land of milk, honey & tech. The country currently stands as No. 1 in terms of R&D expenditure worldwide and counts many established companies, as well as innovative startups, amongst its ranks. Some notable trends:

- Importance of Global VC: 90%+ of R&D in Israel is carried out by the private sector. Israel is the only country among OECD members where more than 50% of R&D is funded by sources outside the country, making the weight of foreign capital in Israeli venture capital extremely important.

- Growth in Tech Employees: 12% of employees in Israel work in high-tech, ranking Israel first globally. While this year saw approximately 7,000 layoffs in Israeli high-tech in 20231 (compared to 240K worldwide), the sector continues to be strong, attractive, and promising. The annual growth rate in the number of high-tech employees has shown growth of 6.3%+ throughout the last decade, compared to 2.2% for the overall economy, meaning the high-tech sector grew at a rate 3x faster than the general workforce. While there was an abundance of employment opportunities in high-tech given the rate of growth of the sector, the average salary for high-tech is nearly 3x higher than the average salary for the rest of the economy, making it extremely attractive for young adults building their careers.

- Emphasis on Future Growth: The Israeli government outlined a goal of reaching 15% (from today’s 12%) in terms of the percentage of Israel’s high-tech workforce as part of the total workforce.

Geopolitical Tensions: Impact of Israel-Hamas War 2023

The impact of the war with Hamas has been significant on the Israeli people and economy. Right after October 7th, it was estimated that the cost of salary for reservists would amount to 5-10B NIS. This was at the time when over 400,000 reservists were called to duty. By November, it was estimated that the war with Hamas is costing nearly 1B NIS per day. A few weeks ago, the Israeli Central Bank estimated that the total cost of the war for Israel would amount to over 200B NIS, or over $50B, but, just last week, exactly three months after October 7th, it was reported on Ynet that the war has already cost Israel 217M NIS, or $58B, thus far.

However, despite the war, we continued to see technology industry exits, noteworthy startup funding rounds, VCs raising and establishing new funds, and dozens of high-tech initiatives to support the war. This trend is in line with previous examples of Israeli economic resilience in the midst of conflict. Startup Nation Central released a report1that analyzes Israeli companies funding during prior conflicts (2006, 2014) and found that the success of companies raising funds during the 2006 conflict (like Wix, SolarEdge, Taboola, Kaltura) was 63% and during the 2014 conflict (like JFrog, Forter, Argus, Payoneer) was 36%. Both rates were higher than those of companies raising funds in conflict-free periods. As investors, this means it is crucial to keep an extra eye on companies raising funding during this period, as they show extreme promise.

What’s more, we have seen the conflict spawn further efforts for innovation, such as NextOctober, whose mission is to fund and build 1,400 startups (1 for every person killed on October 7th), founded by Izhar Shay, former Minister of Science & Technology and entrepreneur, who lost his son on October 7th defending Israel in the Hamas battles in Kerem Shalom and established this in his memory. Another initiative is Frontline Initiative, backing Israeli Founders on the frontline and connecting them with investors and executives who can support them with capital, revenue growth, and talent acquisition. As someone who was at home in Tel Aviv on October 7th, I can say that I have never felt prouder to be Israeli, never felt safer, more connected to those around me, or filled with motivation. It is without a doubt that breakthrough technological advancements and companies have and will continue to emerge from the conflict as we move forward as a nation.

Public Markets, Exits and Funding

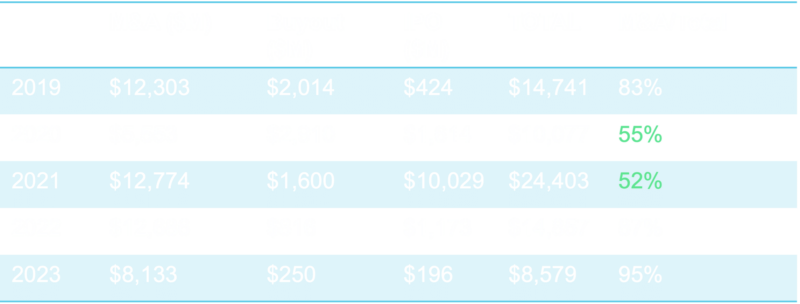

While Israel funding amounted to only 4% of the total funding raised in the USA ($6.9B compared to $170.6B), the exit to capital invested ratio for Israel reached 1.58X compared to 0.4X in the USA, making Israel an extremely attractive market for realized returns, even with a global decline in exits for 2023.

Out of the total realized value of exits in Israel, the vast majority was driven by M&As (full list in “M&As” section below), rather than IPO or Buyout like in 2020/2021. This trend of M&A being the preferred exit vehicle for Israeli companies is typical, but it doesn’t mean it won’t change. Part of the maturation of the Israeli ecosystem entails building long-standing, IPO-ready organizations. With the right opportunities, partners, timing, and global conditions, many more Israeli growth companies may reach an IPO instead of being acquired before reaching their full potential.

IPO

With increased interest rates and an uncertain recession still looming in the USA, the IPO market for Israel companies has remained muted for the most part in the USA, and Israel has followed suit. Only 5 Israeli companies went public in 2023 compared to 17 in 2022. This is a decrease of about 70%, compared to a decrease of just 25% for USA-based companies.

With increased interest rates and an uncertain recession still looming in the USA, the IPO market has remained muted for the most part in the USA, and Israel has followed suit. Only 5 Israeli companies went public in 2023[SK1] [DB2] (Enlight, Oddity, Freightos, Beamr, ParaZero) compared to 17 in 2022. This is a decrease of about 70%, compared to a decrease of just 25% for USA-based companies. Low public multiples (TTM price-to-sales multiple) indicate a continued challenge for companies hoping to exit via IPO and currently sit at 5X compared to 13X in 2021 (PB). A question remains as to how long it will take for the window to open and at what pricing levels companies will have to settle on to deem the IPO opportunity attractive.

That said, Israeli employees play a pivotal role in the continued growth and success of public companies, especially in the security industry, and Israeli-founded public companies show faster growth. On an analysis of the top 25 pure-play cyber companies listed in the US, 80% have an R&D center in Israel and 90% have acquired an Israeli company, with many of these acquisitions happening just this year. The Israeli founded companies (PANW, CHKP, CYBR, S) amount to $130B (15% of summed $900B market cap) and have shown a YoY growth of 115%, 20%, 72%, 90%, respectively, with an average growth of 74% compared to the average YoY growth rate across the 25 companies of just 44%.

M&As

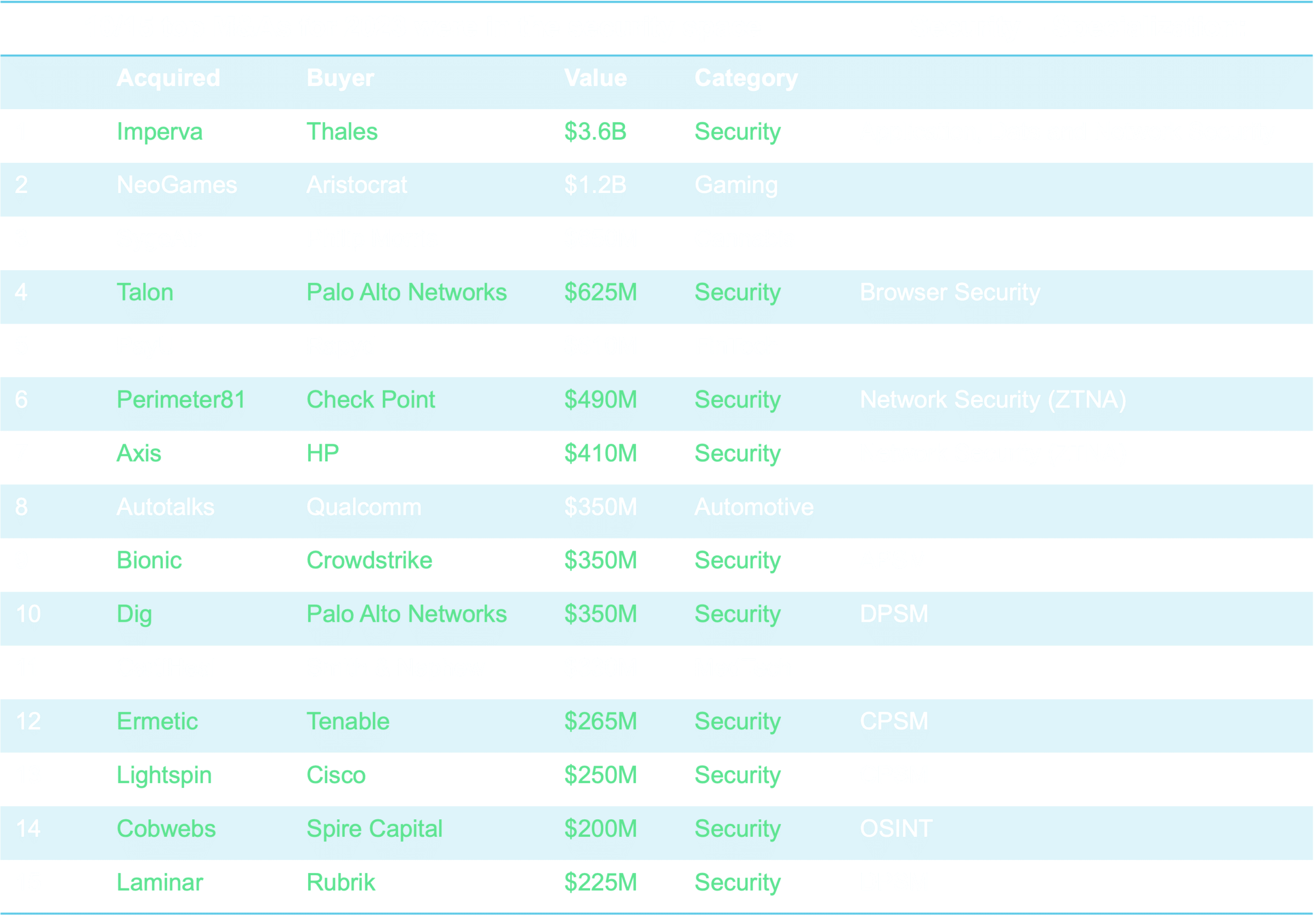

10 of the top 15 M&As in Israel for 2023 were in the security space, driven mostly by acquisitions by USA corporations in terms of quantity, but French multi-national Thales’ acquisition of Imperva (for $3.6B) trumped the value of all other top Israel cybersecurity M&As combined:

Israel Funding

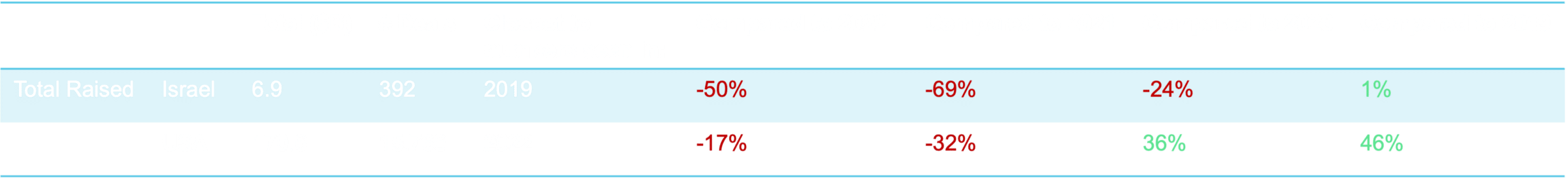

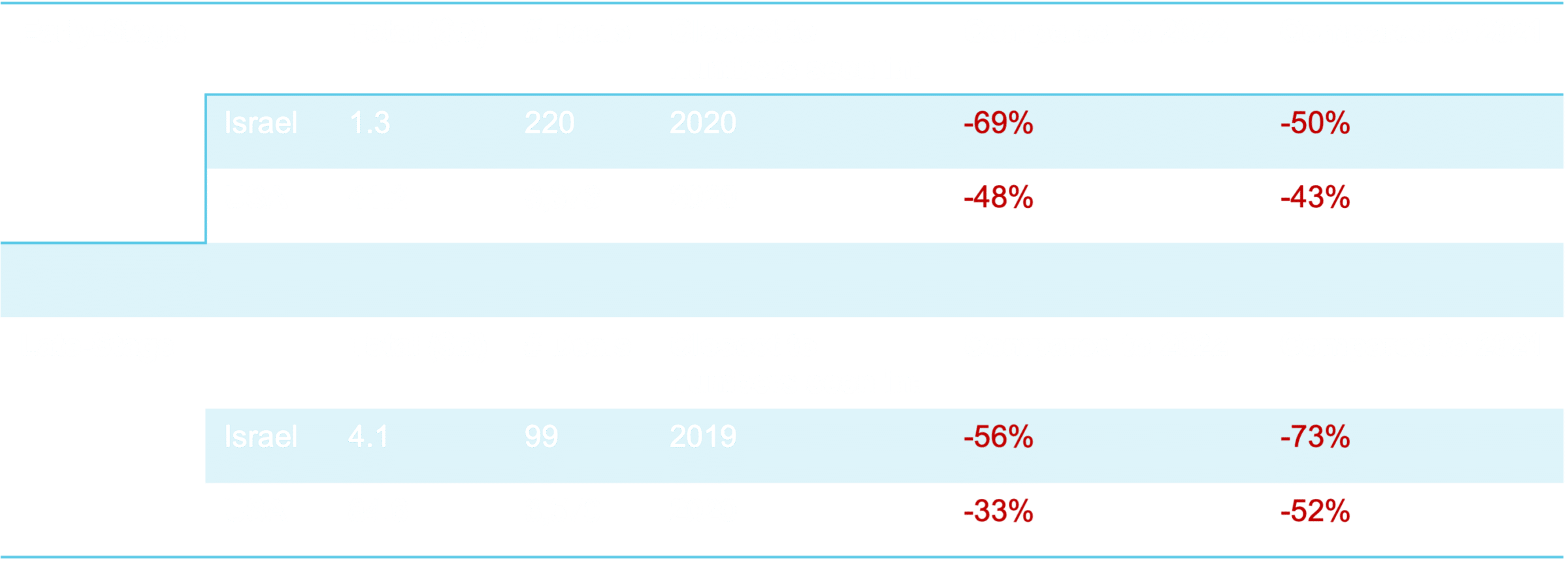

Total raised in 2023 shows Israel took a bigger hit than the USA, with $6.9B raised in Israel, down 50% YOY, and $170.6B raised in the US, down 17% YOY. One reason for this could be that the hype during 2021 was greater for Israeli companies or given the maturation of the USA ecosystem (more dry powder, closer to target customers, more startups available, etc.). It shows slightly greater stability for the USA venture ecosystem compared to Israel. SNC’s end of year report shows that there is an estimate of more than $2B in unreported capital raised by Israeli startups this year (many startups did not report extensions, others might not have reported new rounds given the war). This would bring total funding closer to $10B for 2023, bringing us closer to 2019 levels. However, the same takeaway still stands.

Startups in Israel, like in the US and around the world, continued to lower expenditure levels to increase efficiency and extend capital runway. For companies that want to go public, many are realizing they must focus on profitability and predictability rather than hyper-growth, which requires healthy re-budgeting in the near term and hyper-growth (in the right way) later. However, reducing cash burn cannot sustain a business indefinitely. Many companies that needed to raise funding did so via internal rounds (bridge / continuation / extension rounds) and many did so at flat or lower valuations.

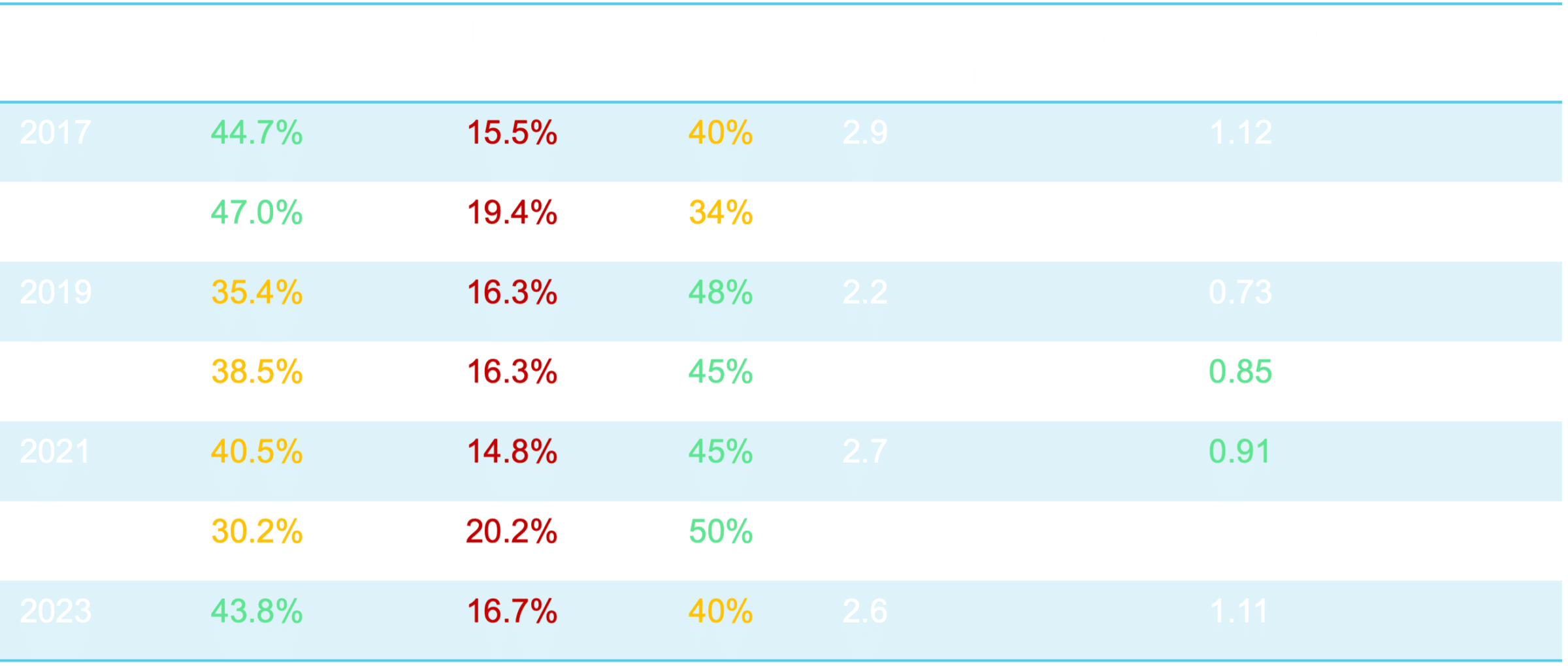

The Israeli ecosystem remains most active in early-stage funding in terms of number of deals made, but we believe a large opportunity remains for younger Israeli companies to continue growth beyond mid-rounds to reach valuations in the multi-billions of dollars before exit. We saw significant hype for early-stage investments in 2021, which is likely the cause of the larger decline for Israeli early-stage investments this past year. We also saw late-stage already returned to pre-pandemic levels, with early-stage expected to follow suit. The ratio of late-stage capital demand to supply is nearly 3X compared to just 1X in 2021 (PB), showcasing an increased opportunity for late-stage investment opportunities for the coming year. The below compares Q1-Q3 only:

Some additional trends to watch:

- Mega-Rounds (above $100M): Israeli mega deals totaled nearly $2.2B raised across 13 deals, 6 within the CSSP market. These deals included Wiz ($300M at a $10B valuation), Cato Networks ($238M at a $3B valuation), Snyk ($196M at a $7.4B valuation), Island ($100M at a $1.5B valuation), Cyera ($100M at a $500M valuation) and Cybereason ($100M at a $3B valuation).

- Unicorn Valuations: While Israel remains #1 in unicorns per capita, 2023 saw only two new unicorns compared to 21 and 40 in 2022 and 2021 respectively. This is not a surprise given normalization of valuations and the focus of later-stage startups on efficiency prior to their next fundraising round to avoid a potential down or flat round. I suspect this trend will continue until the public markets open.

- Cybersecurity most active vertical in Israel: Cybersecurity remained the most active vertical in Israel and accounted for $1.4B (26%) of total funding, with FinTech quickly catching up – both verticals saw a decline of 60% in funding raised 2023 compared to previous years with levels reaching 2019 for cyber and 2018 for Fintech. Noteworthy companies to watch: Mine, Vulcan, Guardz.

- Foreign investors take the lead: For the first time since 2018, the amount invested from rounds with only foreign investors exceeded the amount raised in rounds with a mixture of foreign + Israeli investors, according to SNC’s end of year report. In 2023, the rounds with foreign-only investors were 2.6X the amount of rounds with Israeli-only investors.

Israel Cybersecurity Areas We’re Watching

Some of the top categories in the Israel cybersecurity market that we are keeping our eyes on are broken down into categories below. These represent segments of the market that we find interesting, but are by no means a comprehensive list of the opportunity in CSSP today:

- Emerging tech waves (still developing, some are only feature-based):

- Cloud Runtime Security (CNAPP, CWPP, etc.)

- Remediation Efficiency

- Security for AI

- Passwordless

- Growth-ready companies (platform-based OR high-urgency specialization in an under-served, fast-growing market):

- ITDR / identity

- CRQ & ransomware prevention

- Supply chain security

- Disinformation & misinformation defense, OSINT

- API Security

- TPRM

- Automotive security

- SMB security (under-served market)

- Full-blown cloud security platforms (i.e Wiz, CATO), combining CSPM, CIEM, SASE and more

Moreover, during times of consolidation, companies in specific categories are more likely than others to get acquired in Israel cybersecurity. This past year’s acquisition waves happened in the below categories, and I suspect this will continue in the coming 1-2 years:

- Acquisition waves (feature-based):

- DSPM

- SSPM

- ASPM

- ZTNA

- Cloud runtime security startups (CNAPP, CWPP) – this wave has not yet started, as the category is emerging (for the most part) in Israel, but an acquisition wave is likely to occur for those that will not expand into platforms

Conclusion

While Israel has faced its own challenges this year, it remains an extremely attractive market for investors as well as entrepreneurs looking to build their next company. Known for being the cybersecurity capital of the world (outside of the USA), we are sure to see the ecosystem continue growing, and we at NightDragon are more bullish than ever before.